It’s almost that time of the year again where your attentions turn to what the shape of next calendar year’s budgets should look like.

As a start up or scale up you may not yet have the privilege of a full financial team to pull that data for you but fear not as we are here to help.

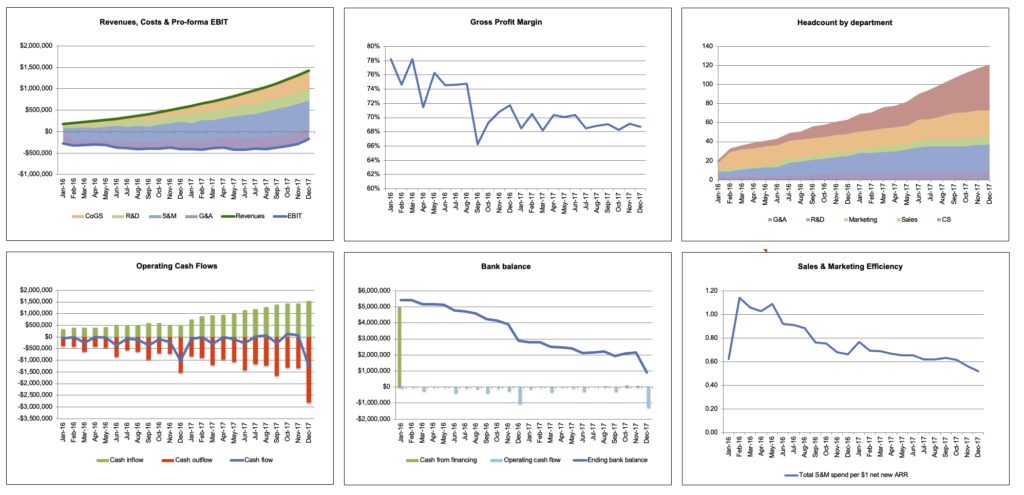

Given the complexities of building solid financial models that you can stand behind with confidence you can be forgiven for putting that initial process off. But do so no more with our favourite early stage and scale up SaaS modelling sheet.

And what’s even better it’s completely free to use. To get your hands on a copy Drop us an email and we will send it through to you in two shakes of a lambs tail!

And fear not, if you run a professional services company we have one for you too! Just send that email, letting us know which version you require and the team will send you the right version.

Need a little extra help? The tips below will help you frame exactly what it takes to get it right, first time:

Here are the top 10 things to keep in mind when building a financial budget for 2025:

- Review Past Performance: Analyze your 2024 financial performance to identify key trends, successes, and areas for improvement. Use these insights to guide 2025 projections.

- Set Clear Goals: Define both short-term and long-term financial goals, including revenue targets, profit margins, and expense controls. Ensure each goal is measurable and aligns with your overall strategy.

- Account for Inflation: Factor in potential inflation, which can increase costs for goods, services, and wages. Use recent inflation data and forecasts to make realistic adjustments. Expect inflation to raise it’s head again in 2025!

- Prioritize Cash Flow Management: Plan for sufficient cash flow by balancing revenue timing with payment schedules. Aim to have reserves for unexpected expenses or slow revenue periods.

- Allocate for Technology & Innovation: Budget for technology upgrades (particularly around AI) that can improve efficiency, customer experience, and scalability.

- Prepare for Economic Uncertainty: Build a contingency fund to cushion against economic fluctuations. Having backup funding ensures flexibility if the economy impacts revenue or costs.

- Incorporate Marketing & Growth Strategies: Invest in marketing, sales, and other growth-driving activities. Plan for both customer acquisition and retention efforts, scaling as revenue allows. Benchmark 5% of ARR!

- Monitor Fixed vs. Variable Costs: Differentiate between fixed and variable costs to understand where flexibility exists. This can help in adjusting expenses if revenue changes.

- Review Debt & Financing Options: If using credit or loans, factor in debt repayment and interest rates. Consider refinancing if it can improve cash flow or reduce expenses.

- Regularly Re-evaluate the Budget: Make the budget a living document by setting up regular review intervals. Adjust as needed based on actual performance, economic shifts, or business changes.

Following these guidelines can help create a realistic, adaptable budget that supports growth and stability throughout the year.

Good luck!