Let’s start with the truth most agency founders won’t say out loud: finance can feel confusing, stressful, and frankly, boring. You didn’t start your agency to stare at spreadsheets. You started it because you’re good at what you do, and because you wanted more control over your work and your life.

But somewhere along the way, the freedom you were chasing got buried under stress. You started hiring, projects got more complex, cash felt tight even when sales were strong, and every decision suddenly came with a knot in your stomach. If that sounds familiar, you’re not alone.

This guide isn’t here to make you a finance expert. It’s here to help you feel confident. To demystify what really matters. And to give you a few key shifts that can unlock calm, control, and sustainable growth.

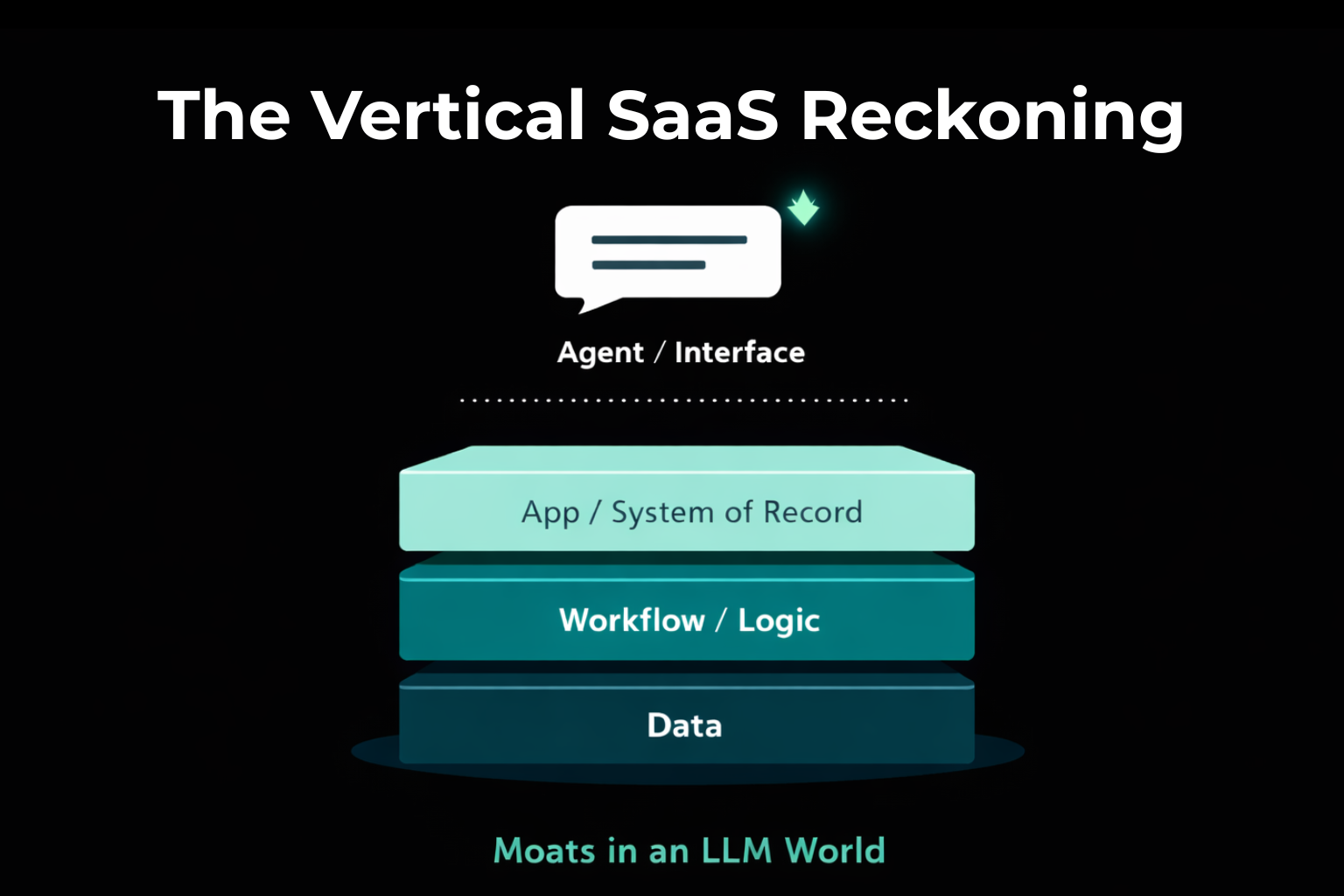

Let’s Get Honest About the Agency Model

Somewhere along the way, someone convinced agency owners that the goal was to stop selling time and build a product. Something scalable. Something subscription-based. The mythical SaaS exit.

And sure, SaaS can be amazing. But 80% of SaaS businesses fail within five years. Meanwhile, many highly profitable agencies sell for great multiples and give their founders true financial freedom.

The trick? They stop chasing the unicorn and double down on building a great service business. One with solid margins, a great team, and clients who stick around.

If you’re burnt out chasing scale, here’s a gentle reminder: a well-run service business is a scalable asset. You don’t need to become a tech startup to build wealth.

Understanding the ‘Finance Maturity Curve’

Most agencies plateau not because they aren’t talented, but because their financial systems can’t keep up with their growth.

At first, you can get away with intuition and hustle. But eventually, decisions get riskier. Cash gets tighter. People expect clarity. You can’t grow past a certain point without upgrading how you manage money.

This is where the Finance Maturity Curve comes in. It has three stages:

- Essential: Just enough to stay legal and avoid chaos. Bookkeeping, VAT returns, invoices going out, payroll happening.

- Enhanced: You start to understand what your numbers mean. You get real reports. You see trends. You can make decisions with data.

- Extended: Finance becomes strategic. You forecast. You scenario plan. You can plan an exit. You sleep better.

Most agencies never move past stage one. Not because they can’t – but because no one ever showed them how.

What Good Finance Actually Looks Like

You don’t need to love numbers. You just need to know what good looks like, so you can hire or build the right support around you.

Good finance feels like:

- Invoices going out on time, getting paid on time

- You knowing how much cash is coming in and out each month

- Monthly reports that show your profit, client margin, and team performance

- Someone else chasing late payments (not you)

- Clear budgets that help you plan hiring, marketing, and investment

- Never being surprised by a tax bill

If none of this is happening in your agency right now, don’t worry. That’s what the next steps are for.

Making the Shift From Founder to CEO

One of the hardest shifts for founders is letting go of the things they’re good at to focus on the things the business needs.

You might love pitching, client strategy, or even delivery. But as the business grows, your job shifts. You have to start working on the business, not just in it.

That means:

- Hiring people who are better than you at their function

- Putting in systems you can trust

- Making decisions based on data, not just gut

It doesn’t mean you become cold and corporate. It means you become intentional. A real leader.

And when you step into that role, your agency stops being a job. It becomes a business that could one day run, grow, and even sell – without you.

Budgeting, Forecasting, and Finding Calm

Let’s take the fear out of budgeting. A budget isn’t a restriction. It’s a story about what you want to create, and the plan to make it happen.

A good agency budget includes:

- Your monthly revenue (from retainers and projects)

- Team costs (including freelancers)

- Overheads (rent, tools, marketing, etc.)

- Your profit target (yes, plan for profit)

It gives you permission to say no to bad work. It tells you when to hire. It helps you avoid accidental losses that creep in while you’re busy delivering.

And when you forecast cash based on that budget, you get peace of mind. You’ll know whether you can afford that new hire. Or if you need to chase invoices today. Or if it’s time to raise prices.

This is how calm happens.