At Scaled, we get asked a lot what’s really happening in the M&A market, and whether now is “the time to sell”. From the conversations we’re having daily with buyers, investors, and founders, one thing is clear: momentum has picked up in recent months, and in the last few weeks it’s accelerated again.

What follows is a distillation of the key themes Simon is seeing, working with founders who are thinking about a sale – now or in the next 12–24 months.

Why more founders are thinking about selling now

For many owner-led businesses, the last few years have been hard work. Even strong performers have had to grind for growth, defend margin and carry heavier delivery pressure. That creates a very human outcome: fatigue. Increasingly, founders aren’t just asking “can I get a good deal?” – they’re asking “do I want to keep doing this at the same intensity?” and “is now the right moment to explore options while I still have the energy to do it properly?”

That’s an important shift. Rising seller interest isn’t only about market timing, it’s about optionality and personal sustainability.

Buyers are more active – and strategics are returning

Private equity has been present throughout the cycle. What’s changed more recently is confidence and activity – and, critically, the return of strategic buyers who have been quieter for a period.

Many strategics have spent the last couple of years focused inward: stabilising operations, protecting profitability and dealing with their own delivery and commercial constraints. As conditions improve, more are back in-market looking for capability, expansion opportunities and bolt-on growth that accelerates their roadmap.

When strategics and PE are both active, the market becomes more competitive from a buyer perspective, which can support stronger outcomes for sellers. But that only holds if the business stands up to professional scrutiny.

Multiples may rise – but only for the best businesses

A more competitive buyer landscape doesn’t lift every business equally. The reality Simon highlights is that higher multiples tend to concentrate around the businesses that are easiest to underwrite: clear performance, repeatable delivery and credible growth.

The best businesses typically share a common ‘feel’ in diligence. Their numbers are clean and explainable, their margins aren’t dependent on heroics and their growth story is backed by evidence rather than optimism. They don’t rely on one or two people to make everything happen, and they can demonstrate that results are repeatable, not accidental.

If those qualities are present, buyer competition can create pricing tension. If they aren’t, the market can be brutal.

More businesses will come to market – and many won’t be ready

Another dynamic playing out at the same time is increased supply: more founders exploring a sale, more processes starting, more ‘testing the market’. The challenge is that a significant portion of these businesses haven’t been optimised for M&A. They’re not bad companies, they’re just not yet buyer-ready in the way professional acquirers require.

That usually shows up in predictable ways: founder dependency, informal systems, inconsistent reporting, unclear unit economics, customer concentration risk and pipeline that exists but isn’t measured or repeatable. Those issues don’t always prevent interest at the start of a process, but they often surface in diligence, where deals slow down, retrade, or fall over entirely.

The hidden risk: doing all the work… and not selling

This is the part Simon is most passionate about avoiding for founders.

A failed process is expensive. Not always in cash – but in time, distraction, emotional energy and opportunity cost. Founders get pulled away from running the business, spend months in meetings and Q&A, and then discover too late that the business can’t pass diligence or can’t justify the valuation expectations that were set early on.

The lesson is simple: it’s far better to get clarity on sellability before committing to a full sale process than to learn the hard way halfway through.

What professional buyers are really assessing

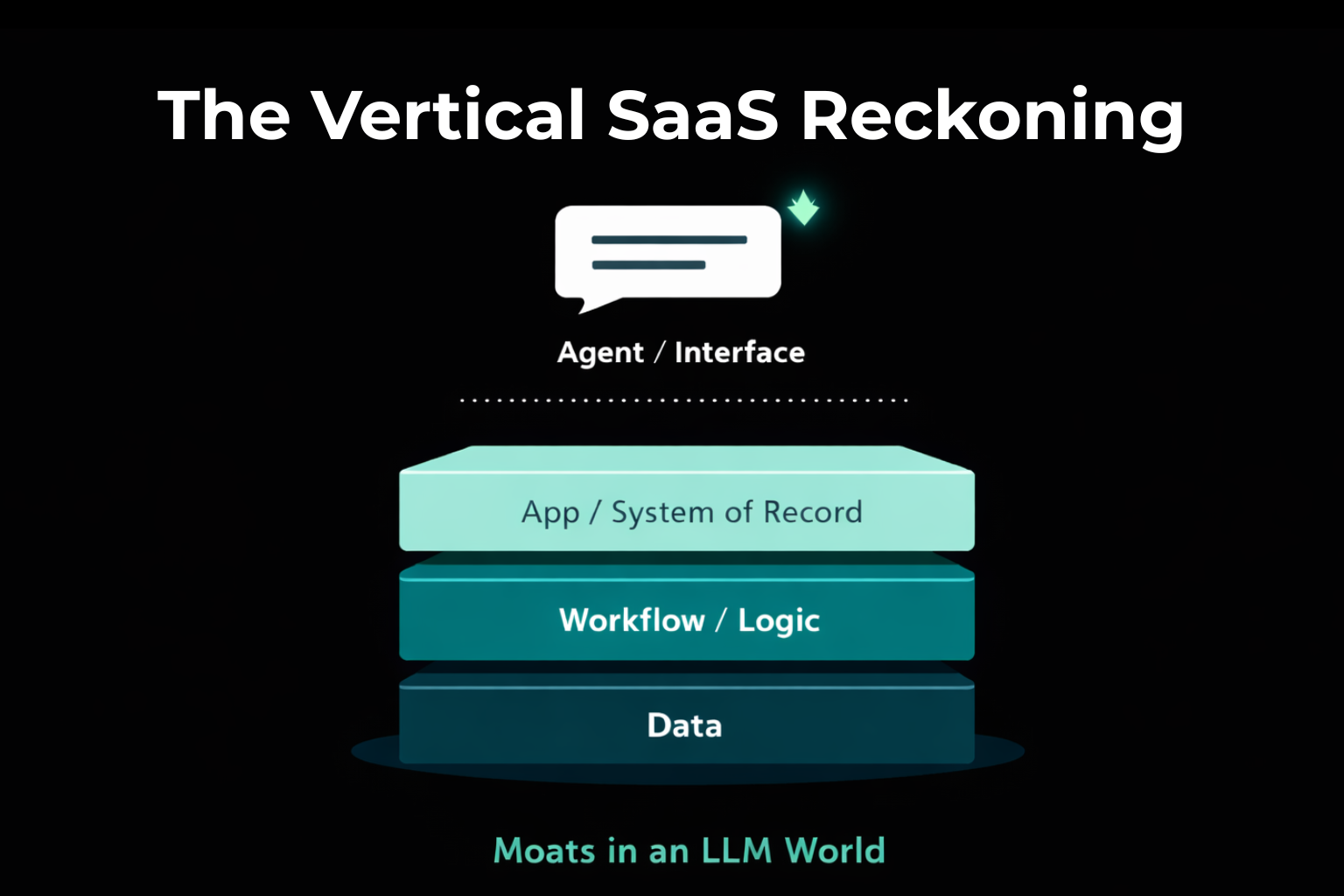

Buyers don’t just buy a P&L. They buy confidence: confidence that earnings are real, that performance is repeatable, that risk is understood, and that growth can be accelerated under new ownership.

In practice, they will pressure-test the quality of earnings, customer risk, the credibility of the sales engine, delivery maturity, the strength of management information and the degree to which the business depends on the founder. If the narrative is strong but the evidence is weak, value is discounted quickly, or the deal becomes too risky to proceed.

What to do if you’re considering a sale in the next 12–24 months

If an exit is even a possibility, the most valuable thing a founder can do now is get an honest, market-informed view on readiness. Not because you must sell, but because clarity creates options. You can sell now if the business is genuinely ready, sell later after de-risking and strengthening value drivers, or choose not to sell but still build a more resilient, valuable company.

Want a grounded view on your exit readiness?

If you’d like a quick, candid view on what the market is likely to value in a business like yours – and what you’d need to fix first to protect value in diligence, get in touch here.